Specialising in structuring complex deals

For sophisticated investors & developers

CAPABILITIES

Initial Meeting

At the outset we spend the requisite time needed to clearly understand a client’s present situation and objectives, and then from there, develop a financing strategy to meet those objectives.

Appropriate Loan Structuring

Correct loan structuring is critical. However, this can vary considerably based on a client’s circumstances and objectives. We will work with you or your advisor to ensure an appropriate solution is implemented.

Releasing Equity

Every lender has a different Credit Policy. We understand the nuances and variations from one lender to another and will be able to recommend options that meet your criteria in order for you to be able to mobilise equity

More competitive loan rates

Interest rates, features, fees and conditions are generally negotiable – optimising these can make a huge difference. We will use the strength of our relationships with lenders to get the best deal.

Independent Loan advice

Poor or conflicting loan advice can prevent you from moving forward. Our knowledge and experience allows us to sort through complex situations and explain matters in simple and easy to understand terms. We pride ourselves on providing ‘client’s best interest advice‘.

We have no bias toward any particular lender and so can be completely independent when offering this advice.

Self Employed and Complex Structures

We deal with complex structuring on a daily basis. Many of our clients are self employed and/or have more than one entity to be reviewed re tax returns and financials.

Often we might be dealing with multiple trusts/properties and businesses. We know which lenders have an appetite for particular structures and know how to present such deals accordingly.

Asset Protection and tax are the 2 most common reasons we are put in touch with a client’s accountant when looking to get loan structuring right.

Property reports

We subscribe to various industry expert services like Core Logic and Price Finder. We are able to provide quality property reporting for all states and territories at no cost to you.

SOLUTIONS

Residential Property Funding

- Purchasing of investment or owner-occupied property

- Refinance and/or equity release

- Debt consolidation and cash flow optimisation

- Rapid debt reduction strategies

- Debt structuring advice/implementation

- Access to over 35 residential lenders plus many other specialist and private lenders

Commercial Property Funding

- Purchase of owner-occupied premises or investor stock

- Refinance and restructuring

- Solutions for standard securities (office, retail, industrial) and specialist e.g. Aged Care, hotels, childcare centres etc.

- Solutions for incomplete financials, irregular income, and professional investors – non-bank deals!

- Access to over 20 commercial lenders and multiple specialist and private lenders

Self-Managed Super Fund Loans

- Solutions available for both residential and commercial scenarios

- This is a specialised area with diminishing numbers of lenders

Construction Loans

- Residential investment e.g. house and land packages

- Home knockdown and rebuild

- Home renovations

- Owner builder options

- Commercial projects

Property Development

- Debt solutions/lenders will be dependent on the type of project

- Experienced with multiple levels of development projects from:

– Simple residential duplex (splitter blocks)

– Residential funding for small unit/townhouse developments e.g. 3 or 4 packs

– Larger resi projects requiring commercial or specialist (non-bank) development finance – senior, mezzanine, JV partners

– The more sophisticated structured deals can be managed/referred on a case by case basis

Equipment and Vehicle Finance

We will readily assist with offering solutions across:

- Commercial Hire Purchases

- Chattel mortgages

- Finance Leases

- Personal Loans

Risk Management and Insurance

During the initial ‘Client Needs Analysis’ discussion phase we will, as part of our duty of care, inquire about a client’s risk/insurance cover. Where required/requested we will refer to our relevant business partner for:

- Life and TPD Insurance

- Income Protection

- Trauma Insurance

- Business Insurance

Business Loans

A variety of loan scenarios could be captured under this heading including:

- Loans to borrowing entities such as companies, or trusts (with personal or corporate trustees) – common vehicles for investors with asset protection and or tax advice

- Loans to trading entities

- Loans to professional/self-employed borrowers purchasing or setting up a practice/business

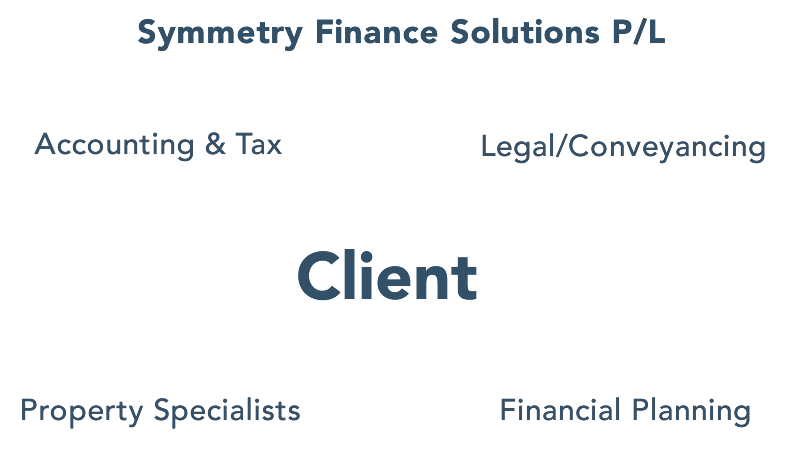

Referral Partners

For those clients investing in or developing property there is a need for a team of expert professionals ranging from Solicitors/Conveyancers to Accountants, Financial Planners and possibly Specialist Property Consultants.

Symmetry Finance has relationships with experts in each of these fields and can refer clients onward as required.

For many clients we work with their own team of professionals. This alignment ensures that the finance element is structured in a manner consistent with the team’s overall strategy.

“David at Symmetry Finance has worked closely with our accountant and solicitors to ensure our finance solutions support our goals and personal circumstances. We highly recommend David's services to our property investor friends and network”.

Andrew and Sharon Y